New Hampshire Medicare Supplement Rates in 2024

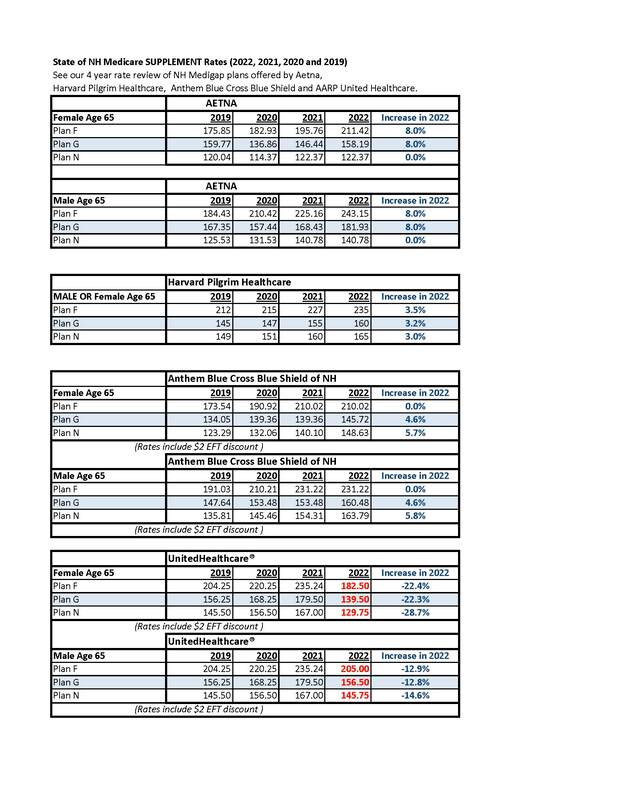

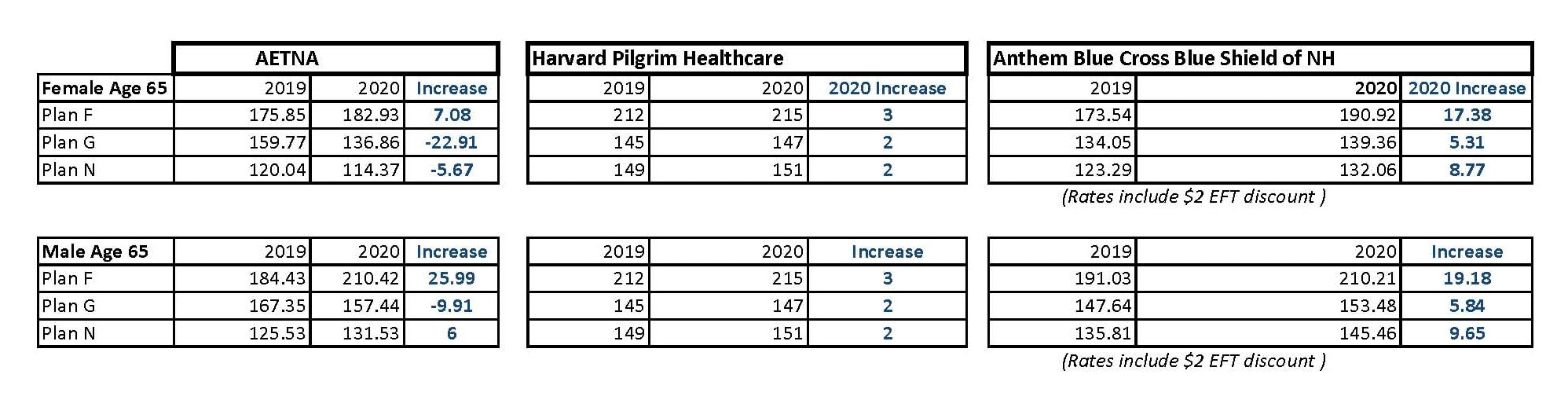

If you’re looking for the lowest Medicare Supplement rates in New Hampshire, here are the details for both male and female beneficiaries at age 65:

Female Rates:

- Plan F: $197 per month (Monitor Life)

- Plan G: $152 per month (United World Life)

- Plan N: $120 per month (CIGNA Health & Life Insurance)

Male Rates:

- Plan F: $226 per month (Monitor Life)

- Plan G: $170 per month (Anthem Blue Cross Blue Shield)

- Plan N: $129 per month (First Health Life & Health Insurance Company)

Keep in mind that these rates are specific to age and gender. If you’re over 65 and want the best rates for your age group, feel free to reach out to us at 603-882-2909 ext. 3. We’re here to assist you.

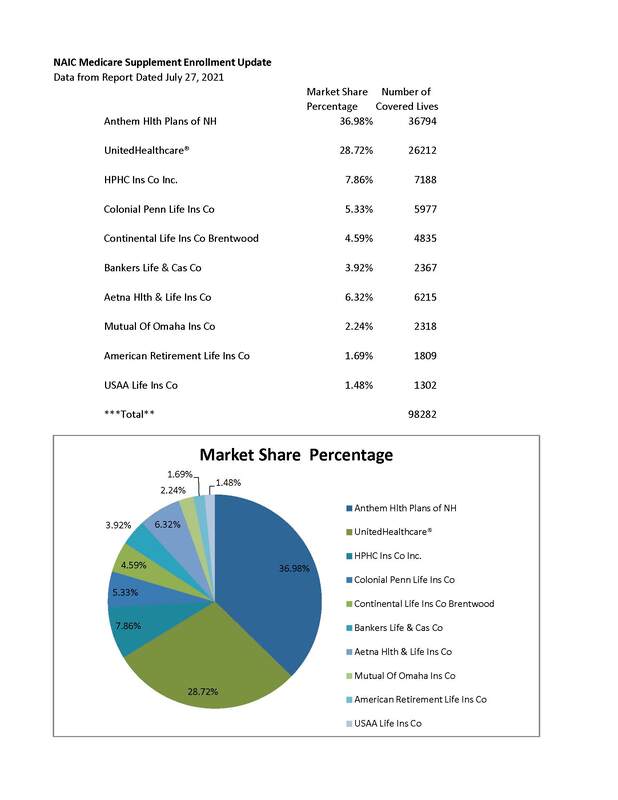

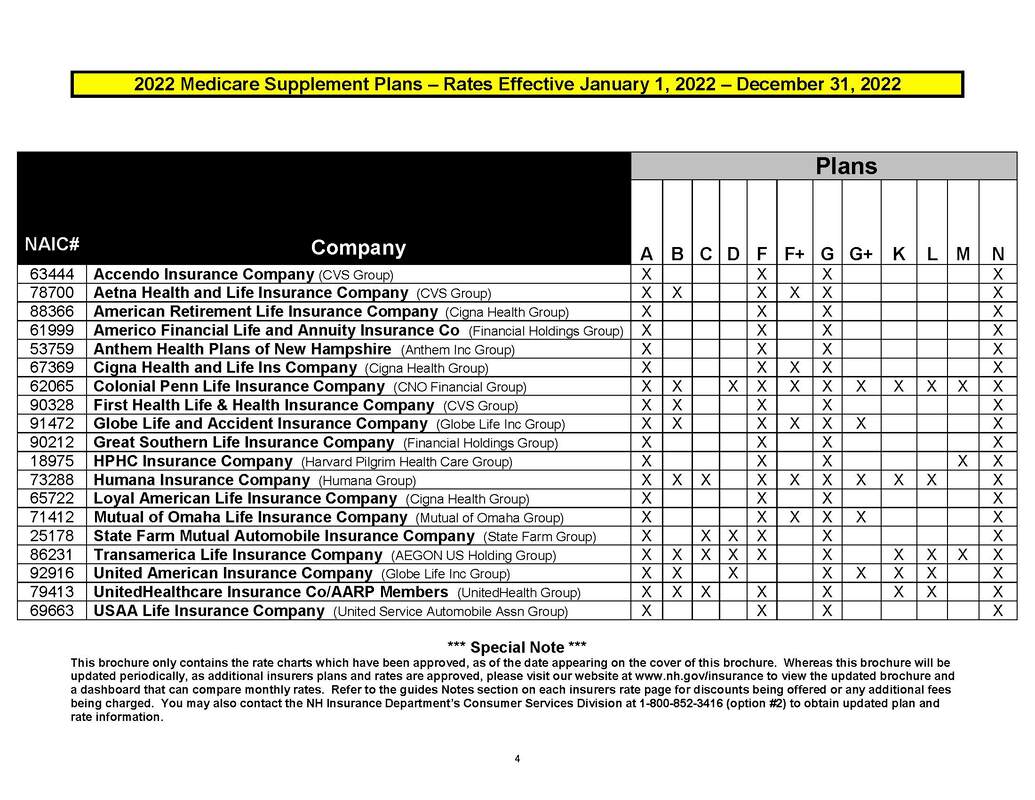

For more detailed information, consult the 2024 NH Guide to Medicare Supplement Insurance Rates, compiled annually by the NH State Insurance Department. This report includes rates for various Medigap plans from 20 different companies offering Supplement coverage in New Hampshire.

Additionally, if you’d like to explore different insurers, check out my blog post where I review New Hampshire Supplement plans.

Remember, if you need help purchasing a New Hampshire Supplement plan or have any questions, don’t hesitate to contact Steve Donohue, NH Medicare broker, at 603-882-2909 ext. 3. We’re available anytime to assist you.

RSS Feed

RSS Feed